China Evergrande Group Total Debt

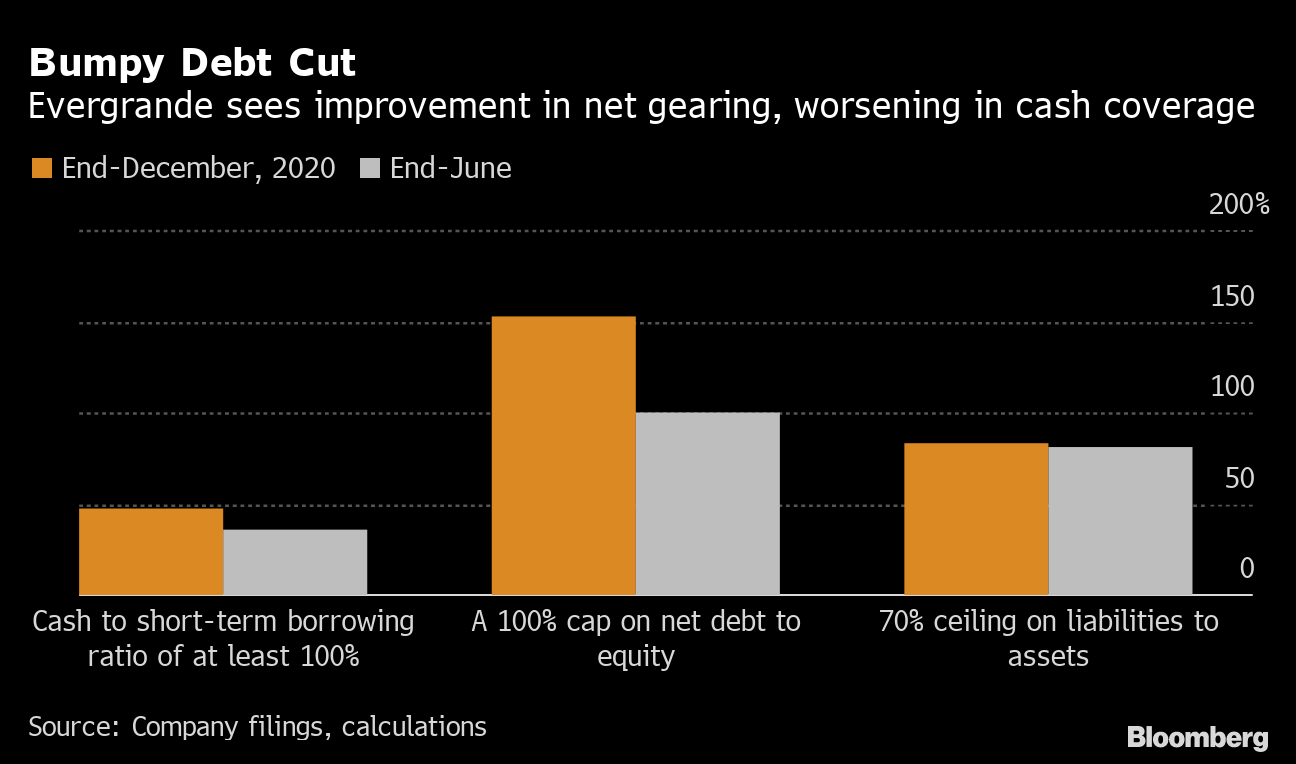

Fitch Ratings has downgraded to B from B the Long-Term Foreign-Currency Issuer Default Ratings IDR of Chinese homebuilder China Evergrande Group and its subsidiaries Hengda Real Estate Group Co Ltd and Tianji Holding Limited. That hands-off approach reinforces the Chinese governments new attitude of bringing down total corporate debt which accounts for almost 160 of the countrys GDP.

Why Evergrande S Debt Problems Threaten China The New York Times

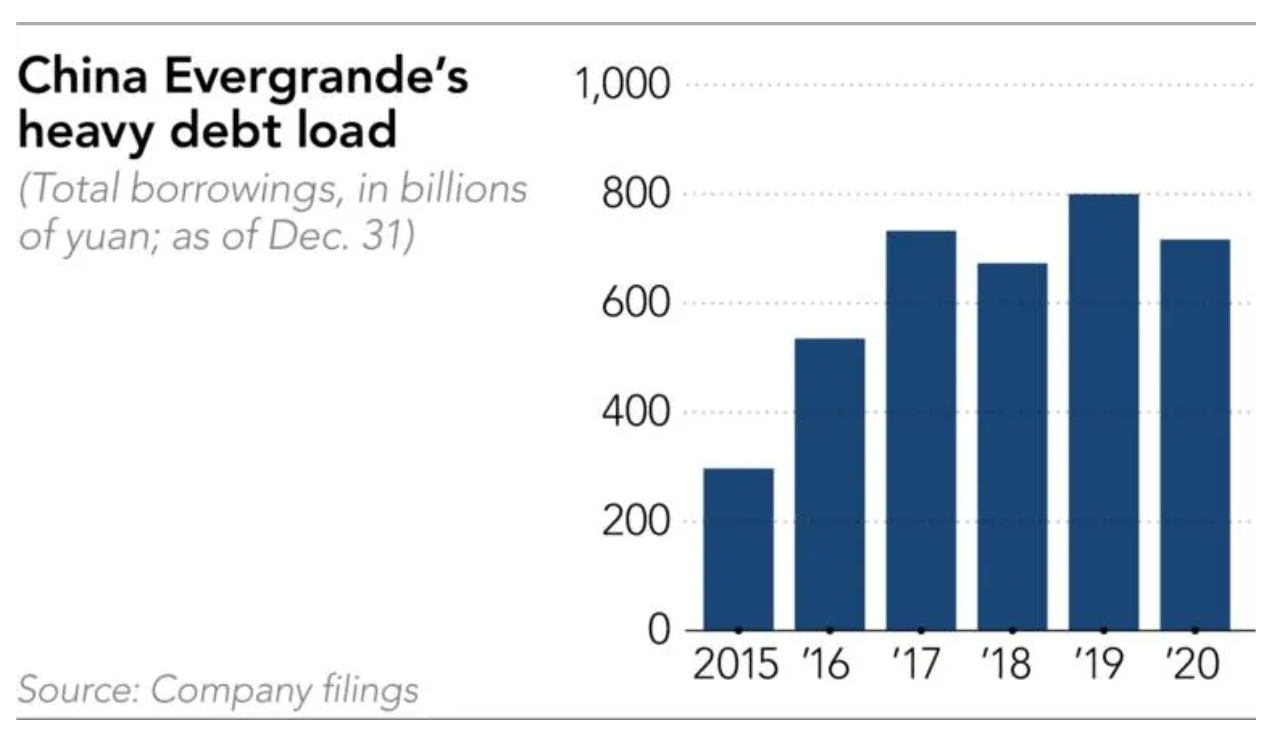

Thats down 20 from 717bn yuan at the end of last year and 15 from 674bn yuan in March.

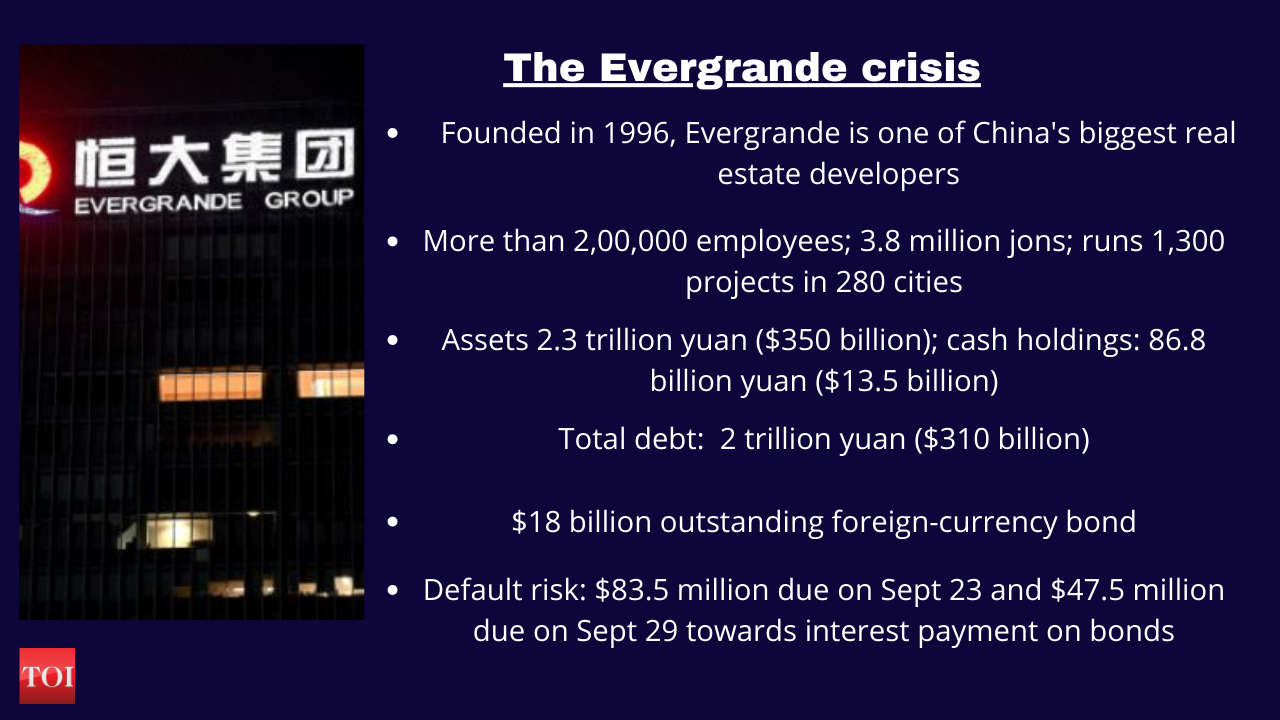

China evergrande group total debt. China Evergrande Groups debt to. Founded in 1996 by Chairman Hui Ka Yan in the southern city of Guangzhou Evergrande accelerated its growth in the past decade to become Chinas second-largest property developer with. Mon 05 Jul 2021 - 453 AM ET.

The problems enveloping Evergrande which has eyewatering total debts of 305bn have hung over global financial markets in recent weeks and helped curb Chinas post-pandemic recovery. China Evergrande Group. China Evergrande Groups Long-Term Debt Capital Lease Obligation for the quarter that ended in Jun.

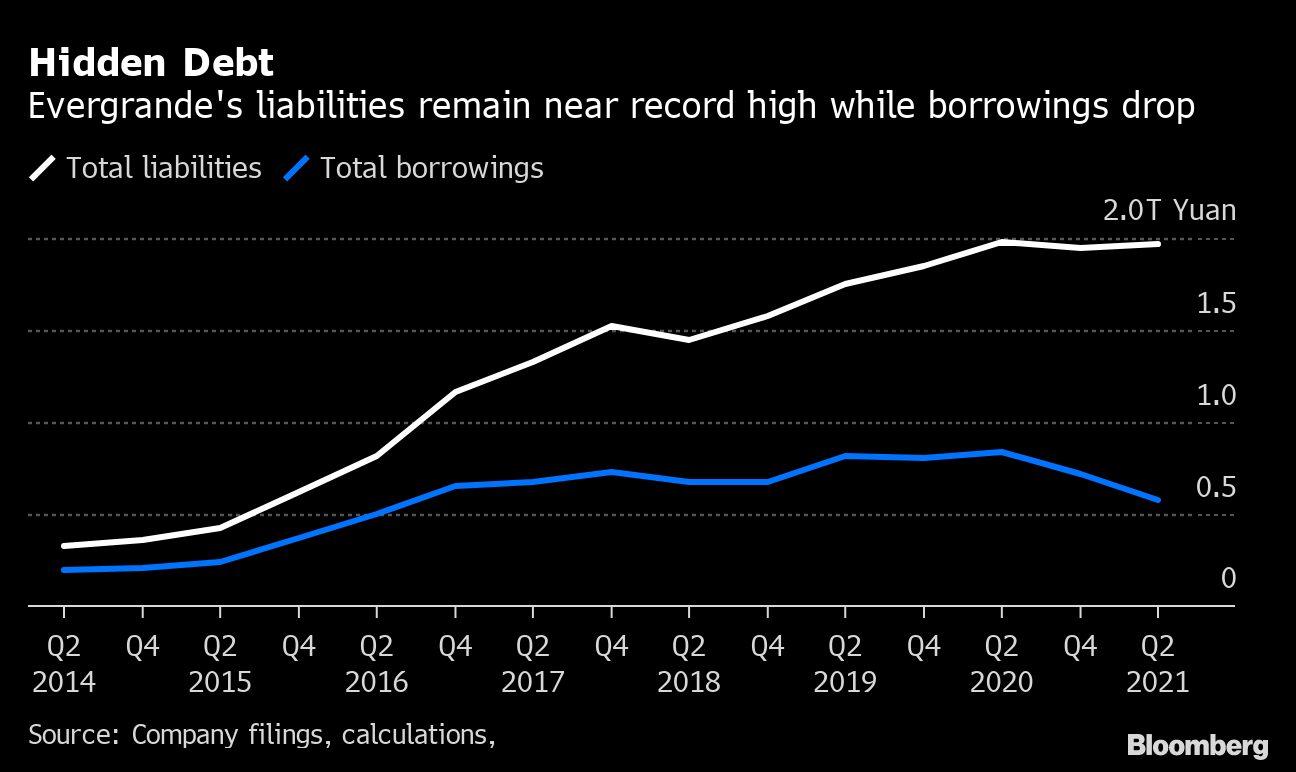

Evergrandes debt shrank to 572 billion yuan according to Bloomberg calculations based on the results. China Evergrande Groups Total Stockholders Equity for the quarter that ended in Jun. Hui Ka Yan founder of Evergrande Group pictured in 2017.

Creditors investors and suppliers of the embattled firm and its peers are top on traders impact list. Evergrandes debt shrank to 572bn yuan according to Bloomberg calculations based on the results. 2021 was 29698 Mil.

The government of the Peoples Republic of China. Worries about Evergrandes ability to repay its debt and a total of 300 billion in liabilities has put global investors on edge about potential spillover into the rest of Chinas real estate. HONG KONG Oct 22 Reuters - China Evergrande Group 3333HK has supplied funds to pay interest on a dollar bond a person with direct knowledge of.

Evergrandes debt shrank to 572 billion yuan according to Bloomberg calculations based on the results. The Outlook is Negative. Thats down 20 from 717 billion yuan at the end of last year and 15 from 674 billion.

In early 2021 Evergrande forecast its total annual transaction volume would surpass 2 trillion yuan 310 billion. 2021 was 51631 Mil. What Is China Evergrande Groups Debt.

Beijing has instructed Evergrandes founder to pay the companys debt with personal funds Bloomberg reported. HONGKONG China Evergrande Group has supplied funds to pay interest on a dollar bond a. Beijing has not stepped in to aid Evergrande which carried more than 300 billion in total liabilities at the end of the second quarter according to Market Intelligence data.

Staff dormitory at the construction site of a residential property project developed by China Evergrande Group in the Guangdong provincial capital of Guangzhou on June 22 2012. Chinese officials and state media have been largely silent on the crisis at Evergrande which has missed a series of bond interest payments and has 300 billion in debt making it the the worlds. However because it has a cash reserve of CN1619b its net debt is less at about CN5715b.

Of that debt 240 billion yuan 373 billion was due within a year nearly triple Evergrandes 868 billion yuan 135 billion in cash holdings according to a company financial report. Evergrande Group and Chinas Debt Challenges Concerns about Chinas high debt levels intensified in September 2021 when its second-largest property developer Evergrande Group failed to repay its debt obligations. Still trade and other payables climbed 15 from six months earlier to a record 9511 billion yuan.

Thats down 20 from 717 billion yuan at the end of last year and 15 from 674 billion yuan in March. Explainer-How China Evergrandes debt troubles pose a systemic risk. The image below which you can click on for greater detail shows that China Evergrande Group had debt of CN7334b at the end of December 2020 a reduction from CN8190b over a year.

In depth view into China Evergrande Group Debt to Equity Ratio including historical data from 2015 charts stats and industry comps. Bloomberg -- China Evergrande Groups debt crisis might not be Chinas Lehman moment but it has sent ripples through stocks tied to the developer and the worlds second-biggest economy. Evergrande Group founded in 1996 is one of Chinas biggest builders of apartments office towers and shopping malls and one of its biggest private sector conglomerates.

Debt Laden Evergrande Raises More Debt Financial Times

What Is The Evergrande Debt Crisis And Why Does It Matter For The Global Economy World Economic Forum

Evergrande S Woes Worsen With Liabilities Over 300 Billion Bloomberg

Evergrande S Rising Default Risk All You Need To Know Times Of India

Evergrande S Fiasco Could Hit China S Economy Npr

Evergrande S Woes Worsen With Liabilities Over 300 Billion Bloomberg

Evergrande Seeks Safe Descent From Usd 130 Billion Debt Mountain Krasia

Will Xi Jinping Take Politically Uncomfortable Stance To Solve Evergrande Crisis Businesstoday

Dna Explainer How Downfall Of China S Evergrande Will Impact Global Markets

/cloudfront-us-east-2.images.arcpublishing.com/reuters/IKVVW7XKERNAZO7CX6IVGD5UNI.jpg)

Evergrande Misses Payment Deadline Ev Unit Warns Of Cash Crunch Reuters

China Developer Evergrande Debt Crisis Bond Default And Investor Risks

Timeline Of A Crisis The Worsening Finances Of China Evergrande Asia Financial News

Explainer How China Evergrande S Debt Woes Pose A Systemic Risk Reuters

China S Debt Ridden Evergrande Group Says It Will Make Bond Payment Business Standard News

The Chinese Property Developer More Geared Than Evergrande Asia Markets

China Developer Evergrande Denies It S Seeking Government Support Caixin Global

What Is China Evergrande And Why Is It In Trouble Bloomberg

Evergrande Why The Chinese Property Giant Is Close To Collapse Business Economy And Finance News From A German Perspective Dw 16 09 2021